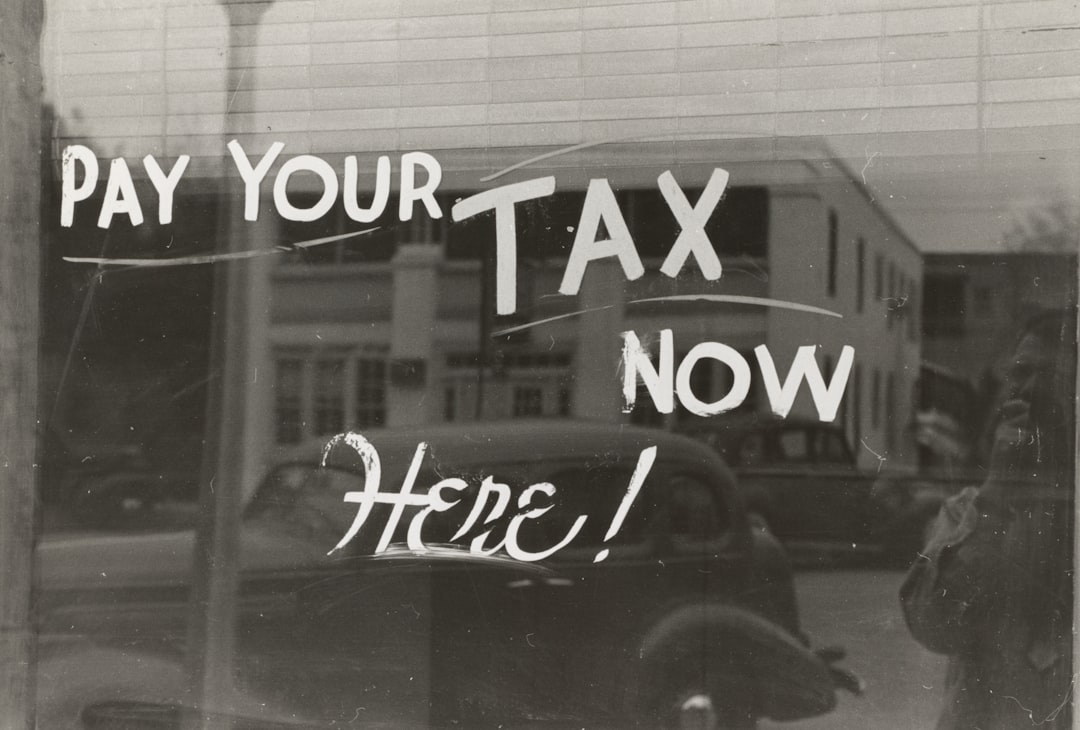

Preparing For 2020 Tax Season

It’s standard to expect adjustments to the tax code, but 2018 saw sweeping changes with the 2017 Tax Cut and Jobs Act, the biggest change in about 30 years. So, this year, implementing changes from this Act are still affecting businesses as well as new changes effective January 1.

For the 2020 tax season, make sure you’re aware of these and any changes that affect your business.

- Employee Withholding Certificate. If you have employees and a payroll, then be sure you’re aware of the new 2020 Form W-4, Employee’s Withholding Certificate. This is the document that allows employees to claim exemptions, lessening the amount of income taxes you withhold. Previously, employees selected exemptions, but now there is a new method to determine their withholding allowance. The new form has a five-step process to determine total allowances with the goal to improve accuracy of withholdings.

- Deductions Cap. If you are a pass-through business, such as a sole proprietor, partnership, or S corp, you want to pay attention to the SALT Cap. The State And Local Tax (SALT) Deduction allows you to deduct your state and local income taxes and property taxes. Previously, the amount to deduct was unlimited, but for 2020, there is a cap at $10,000 per tax return. This could affect businesses operating in high-tax areas—the cap does not shift to account for regional difference in tax rates, so you may not receive as much back as a business with the same deduction that operates in an area with lower taxes.

- Retirement Adjustments. This year will see slightly higher contribution amounts for both employees and employers to any tax deferred benefit. Be sure you consult the IRS Tables to ensure you allow for the correct amounts. Also, the SECURE (Setting Every Community Up for Retirement Enhancement) Act allows small businesses to create Multiple Employer Plans and reduce costs for setting up retirement accounts. Finally, the minimum age at which employees can begin to draw on their retirement accounts rose from 70 ½ to 72 years old.

Consult A Professional

As with any business practice, make sure you work with professionals who will guide you through these changes and ensure your business receives every benefit while avoiding any pitfalls. From determining your tax bracket to managing your employees’ payroll, you want to be accurate and ensure your business follows the law.