Top News

HR/Benefits

Explore how flexible work arrangements are positively impacting employee morale and productivity. Learn about the latest HR trends in adaptive work settings.

-

Navigating the Rise of Remote Work Benefits in Modern HR Landscape

Thursday, 05 March 2026

-

Revolutionizing HR with AI: The Future of Workforce Management

Sunday, 18 January 2026

-

Navigating the Evolving Landscape of Employee Benefits: Current Trends and Insights

Sunday, 11 January 2026

-

The Evolving Landscape of Employee Benefits in 2024

Sunday, 11 January 2026

Legal

Explore the rising trend of ESG litigation and how companies are navigating the associated legal challenges through governance, transparency, and proactive compliance measures.

-

Do You Need A Registered Agent For Your Business?

Tuesday, 22 October 2019

-

Creating a Promissory Note

Monday, 16 September 2019

-

5 Ways Businesses Can Avoid Becoming Ensnared In An Ethical Lapse

Monday, 30 July 2018

-

Mediate, don’t litigate

Wednesday, 11 October 2017

News

Explore the rise of Environmental Accounting and its impact on modern businesses, emphasizing sustainability, corporate responsibility, and long-term success.

-

The Rise of Remote Work: Transforming Business Operations in Today's World

Sunday, 23 November 2025

-

Navigating Current Market Volatility: Strategies for Business Leaders

Sunday, 14 September 2025

-

Navigating the Wave: Small Businesses Thrive Amid Economic Uncertainty

Sunday, 31 August 2025

-

The Surge of Green Financing in the Business World

Sunday, 24 August 2025

Technology

As a small business, you face the same cyber threats as large enterprises. However, unlike the larger companies, you likely don’t have the same IT budgets to leverage sophisticated security solutions. Regardless of the size of your business, implementing cybersecurity best practices is crucial to safeguard sensitive customer data, financial information, intellectual property, and your reputation. Follow these practical tips to lock down your critical assets without breaking the bank.

-

DIY Tips for Improving Your Small Business Website on a Budget

Monday, 27 November 2023

-

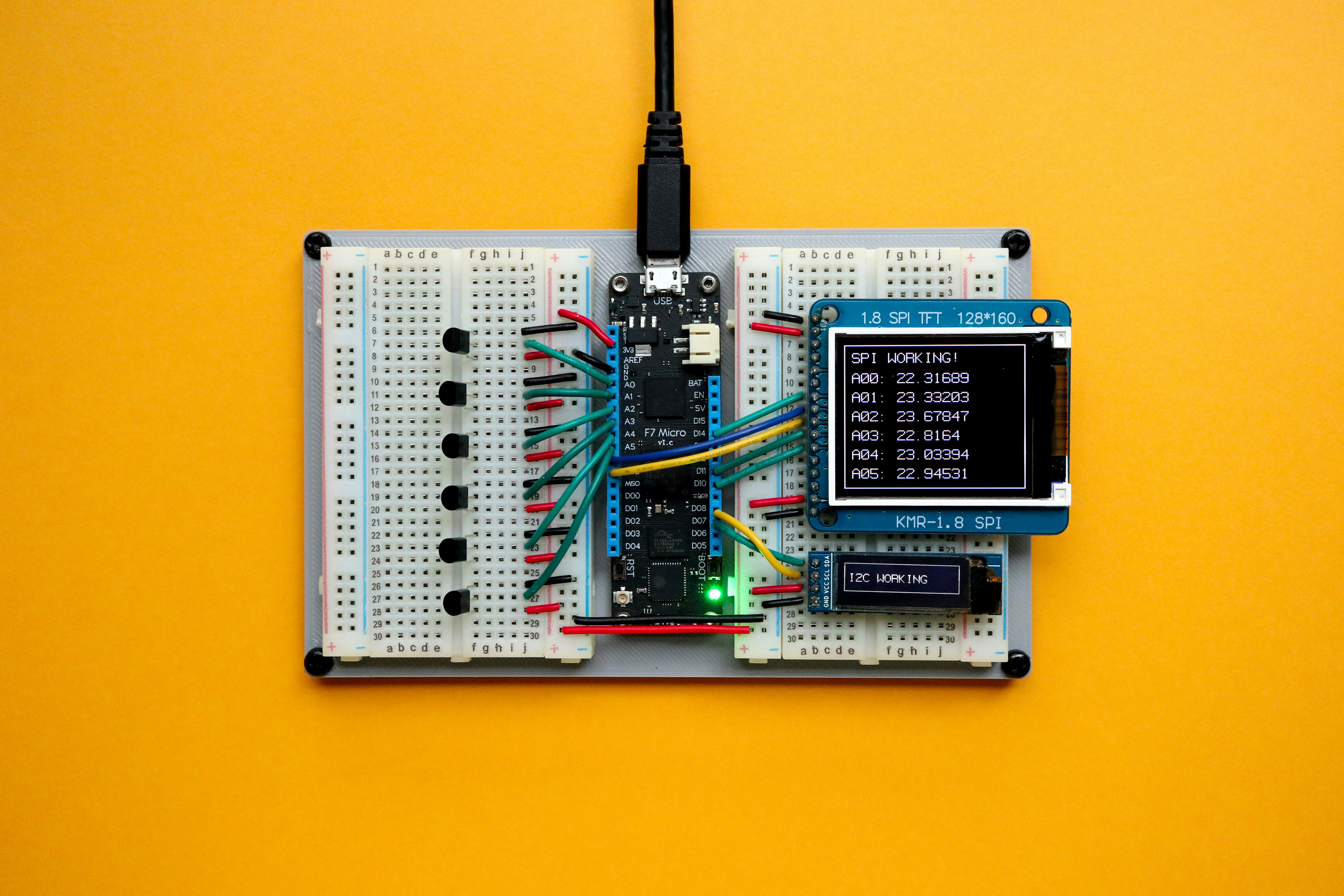

The Role of Internet of Things (IoT) in Small Business Operations

Monday, 09 October 2023

-

Tips for Effective Data Backup and Recovery in Small Businesses

Monday, 02 October 2023

-

The Benefits of Voice Search Optimization for Small Business Websites

Monday, 25 September 2023

The Surge of Environmental Accounting: Navigating Modern Business Landscapes

Explore the rise of Environmental Accounting and its impact on modern businesses, emphasizing sustainability, corporate responsibility, and long-term success.

Explore the rise of Environmental Accounting and its impact on modern businesses, emphasizing sustainability, corporate responsibility, and long-term success.

Environmental Accounting refers to the incorporation of environmental costs into business accounting practices. It evaluates the environmental impact of business activities, helping organizations identify their ecological footprint and adjust practices to foster sustainability. This burgeoning trend is critical, as stakeholders now demand accountability not just in financial performance but also in environmental responsibility.

The case of Interface Inc., a global leader in modular flooring, exemplifies the application of Environmental Accounting. In the mid-1990s, Interface embarked on a mission to become a sustainable enterprise by 2020. They implemented an Environmental Accounting system that allowed them to track and evaluate the environmental impact of every decision, leading to innovations that reduced their carbon footprint significantly while boosting profitability.

Implementing Environmental Accounting effectively requires organizations to integrate non-financial metrics into their traditional accounting systems. This involves detailed reporting of energy use, waste management, water consumption, and emissions. By doing so, companies can measure how their environmental initiatives impact the bottom line, ensuring alignment with both financial and ecological goals.

As this trend continues to gain traction, regulatory bodies are placing greater emphasis on environmental disclosures. The upcoming financial reporting frameworks are expected to mandate transparency regarding environmental risks and opportunities. Thus, businesses must be proactive in adopting Environmental Accounting to remain compliant and competitive in the global market.

Companies like Unilever and Patagonia have demonstrated that adopting sustainable practices does not hinder financial success but instead promotes a positive brand image, which can lead to increased consumer loyalty and market share.

Conclusion: Environmental Accounting is no longer optional; it's a necessity for businesses aiming for long-term success in today's world. By embracing this trend, companies can drive innovation, engage stakeholders, and fulfill regulatory expectations while contributing positively to the planet.

The Rise of Remote Work: Transforming Business Operations in Today's World

Discover how the rise of remote work is transforming business operations, driving efficiency, and enhancing workforce management in today's dynamic landscape.

Discover how the rise of remote work is transforming business operations, driving efficiency, and enhancing workforce management in today's dynamic landscape.

With the onset of the global pandemic, companies were compelled to adopt remote work models almost overnight. As we transition to a post-pandemic world, this trend has proven to be more than just a temporary adjustment. Businesses are increasingly recognizing the benefits of remote work in enhancing operational efficiency and employee satisfaction.

Remote work has enabled companies to tap into a global talent pool, unrestricted by geographical limitations. This access to diverse skill sets has proven advantageous for many firms, fostering innovation and creativity. Moreover, it has led to cost savings in terms of reduced office space and associated overheads.

However, the transition to remote work has not been without its challenges. Businesses have had to invest in digital infrastructure to ensure seamless communication and collaboration among remote teams. This includes the adoption of cloud-based solutions, video conferencing tools, and project management software. The key to success lies in finding the right balance between technological investments and maintaining human connections.

Moreover, workforce management in a remote setting necessitates a shift in leadership styles. Leaders are tasked with building trust, promoting transparency, and ensuring accountability within their teams. Regular check-ins, feedback loops, and clear goal-setting have become essential components of effective remote management.

As businesses continue to adapt to this new normal, it is evident that remote work is here to stay. Companies that embrace this shift and strategically integrate remote work into their operational frameworks stand to gain a competitive edge in the evolving business landscape.

From my experience working with top accounting and finance firms, I have witnessed first-hand how remote work has helped in streamlining operations, increasing productivity, and improving employee well-being. The journey to mastering remote work practices may come with its trials, but the rewards are undoubtedly worth the effort.

Navigating Current Market Volatility: Strategies for Business Leaders

Discover effective strategies for business leaders to navigate market volatility, focusing on risk management, technological innovation, and fostering resilience.

Discover effective strategies for business leaders to navigate market volatility, focusing on risk management, technological innovation, and fostering resilience.

One key strategy involves enhancing risk management practices. Businesses are revisiting their risk assessment frameworks to ensure they can quickly identify and mitigate potential threats. This includes diversifying supply chains, maintaining strong cash reserves, and implementing robust cybersecurity measures.

Another approach is embracing technological innovation. Companies leveraging advanced analytics and artificial intelligence are better positioned to adapt to rapidly changing conditions. For instance, during my tenure at Deloitte, I observed firms that successfully integrated real-time data analytics into their operations outperformed their peers in responding to market changes.

Moreover, fostering a culture of agility and resilience is crucial. Organizations that encourage flexible thinking and adaptability within their teams can pivot more effectively in response to unexpected disruptions. Ernst & Young's workshops on adaptive leadership highlight how businesses that prioritize these qualities navigate volatility with greater success.

Lastly, maintaining open lines of communication with stakeholders helps mitigate uncertainty. Transparent dialogue with investors, customers, and employees builds trust and aligns expectations, reducing the potential impact of market swings.

Incorporating these strategies allows businesses not just to survive but to thrive amid market volatility, turning challenges into opportunities for growth and innovation.

Navigating the Wave: Small Businesses Thrive Amid Economic Uncertainty

Explore how small businesses are thriving amid economic uncertainty through digital innovation, community support, and strategic agility.

Explore how small businesses are thriving amid economic uncertainty through digital innovation, community support, and strategic agility.

One of the primary drivers aiding small businesses is the strategic adoption of digital technologies. By embracing e-commerce platforms and utilizing social media for marketing, small enterprises can reach broader audiences at reduced costs. This digital transition is not merely a trend but a critical aspect of remaining competitive in the modern age.

To illustrate, consider the case of a small bakery in Austin, Texas. Traditionally reliant on local foot traffic, the bakery transitioned to online sales during challenging times, tapping into a national customer base. By doing so, it increased monthly revenue by 30%, showcasing the potential of digital platforms to drive growth.

Moreover, the rise of community support and emphasis on local shopping has bolstered small businesses. Consumers are increasingly prioritizing purchases from local vendors, promoting a sense of community and ensuring the circulation of money within the local economy. This shift toward local shopping presents a unique opportunity for small businesses to engage with their communities more meaningfully.

Another critical strategy is the focus on agility and flexibility. Small businesses are inherently more nimble than larger corporations, allowing them to pivot quickly in response to market changes. Whether it's adjusting supply chains, diversifying product lines, or adopting new business models, this agility is critical for navigating economic volatility.

Financial management also plays a crucial role. Small businesses that maintain robust financial planning and cash flow management are better positioned to withstand economic shocks. Leveraging accounting software and seeking professional financial advice can contribute significantly to long-term sustainability and growth.

Finally, collaboration and partnerships have emerged as valuable tools for small businesses. By forming alliances with other businesses or engaging in cross-promotions, small enterprises can amplify their reach and resources. Such partnerships can lead to shared success, opening doors to new markets and customer segments.

In conclusion, while economic uncertainty poses significant challenges, it also presents opportunities for small businesses to innovate and grow. By focusing on digital transformation, community engagement, flexibility, robust financial management, and strategic partnerships, small enterprises can not only survive but thrive in a rapidly changing world.

Cloud-Based Accounting Solutions to Reduce Overhead Costs

Cloud-based accounting solutions offer a cost-effective way for businesses to manage their financial operations while reducing overhead costs. With the ability of these accounting solutions to move their accounting tasks to the cloud, companies can avoid the need to invest in additional headcount, office space, and equipment like computers and printers. This can result in significant savings, as these expenses can be quite substantial.

In addition to eliminating the need for physical infrastructure, cloud-based accounting also eliminates the need for costly training courses for employees who are new to the job. With cloud accounting software, employees can easily access and use the system without extensive training, saving both time and money.

The ability to integrate with other software applications is one of the leading advantages of cloud accounting. Cloud accounting software can seamlessly connect with customer relationship management (CRM), enterprise resource planning (ERP), and marketing automation tools. Such ease of integration allows for streamlined data flow between different systems, eliminating the need for manual data entry and reducing the chance of errors.

For example, cloud accounting systems often integrate with marketing automation tools like Salesforce Pardot and HubSpot. This integration ensures that data from sales leads automatically syncs into the financial dashboard without any additional work on the part of the user. This not only saves time but also improves data accuracy, allowing businesses to make informed financial decisions.

Additionally, cloud accounting systems can significantly reduce operational costs. Cloud technology can be leveraged by businesses, hence they will no longer need to purchase expensive hardware and software for their accounting needs. With this, the initial capital expenditure and ongoing maintenance cost associated with the traditional on-premise solutions is eliminated. Additionally, businesses can benefit from automatic software updates and upgrades provided by cloud vendors at no extra cost.

Cloud accounting systems also allow users to access their financial data from any location at any time. This enables users and organizations to save time and increase productivity. With cloud accounting, there is no longer a need to be tied to a specific office or computer to access financial information. This flexibility empowers employees to work remotely and collaborate effectively, resulting in increased efficiency.

According to Nucleus Research, cloud deployments can incur 63% lower initial consulting and implementation costs compared to on-premise solutions. This cost advantage makes cloud accounting an attractive option for businesses of all sizes. The pay-per-use pricing model further adds to the cost-effectiveness, as businesses only pay for the resources they actually use, without any upfront investment.

In summary, cloud-based accounting solutions offer numerous benefits for businesses looking to reduce overhead costs. Cloud technology helps companies avoid the need for additional headcount, office space, and equipment. The integrations capabilities of cloud accounting software streamline data flow and improve financial decision-making. Additionally, cloud accounting systems reduce operational costs by eliminating the need for expensive hardware and software purchases, while providing automatic updates and upgrades. The accessibility of cloud accounting improves productivity and allows for remote working. With its cost-effective pricing model, cloud accounting is a valuable solution for businesses seeking to reduce overhead costs and optimize their financial operations.

Digital Automation & Tax

This year, technology will continue to have a growing role in tax departments as they look to do more with what they already have. Digital automation will quickly become an important tool in companies and workforces as business leaders look to make decisions quicker.

The first step is to evaluate your business to better understand the processes that are already established and the goals you’re trying to achieve. Business Process Reengineering – recreating business processes with the goal of improving product output, quality, or reducing costs – is a helpful tool to accomplish this.

After the initial work is done, it’s time to evaluate where automation will be the most effective. In most cases, this will be in departments that leverage large amounts of data in their processes.

Let’s take tax departments as an example. Tax departments are known for having detailed and complex processes that synthesize a lot of data. Manual processes for tasks like reconciliation are particularly challenging. This is where automation can help spot anomalies that might slip through the cracks.

Across the industry, we’re seeing companies driving towards implementing e-invoicing and e-reporting. E-invoicing creates a system that standardizes the format of the e-invoice and transmits it to the proper tax authorities to receive validation in real-time. It also exchanges the transaction between the buyer and seller and retains a copy. This copy is important so tax teams can comply with periodic electronic reporting requirements.

Branching off this process, the digital journey also includes complying with the different invoicing requirements tax administrations implement on the business-to-consumer side, which is important for businesses looking to expand globally. Each country has specific requirements for invoicing, including language, currency, format, tax calculations, format and signatures. Automating the invoice process makes compliance with these regulations easier.

These trends show that automation is continuing to increase, which in turn decreases the workload for tax teams. Digitizing these processes can help accountants work through the complexity of requirements across different jurisdictions and countries. This is especially applicable to those working with a large volume of business transactions and helps to ensure their integrity.

While automation continues to make manual processes easier, it will leave your team with more time to focus on other business processes such as supporting audits or driving and creating new initiatives. With workforces facing labor shortages, economic barriers and supply chain issues, organizations need to find ways to buy back time and energy using technology.

Collaboration within your organization will be key to achieving these goals. Make sure there is a partnership between the IT teams and departments looking to implement automation. This will create an understanding of each team’s needs and allow for the common goal to be reached.

Remember, the best digital transformations happen over time. Don’t rush the process or fall victim to the “I need it all” mindset. The most successful leaders understand that automation isn’t a one-size-fits-all, but rather a useful tool that should be tailored to the business goals of the organization or department.

Bio: Chris Zangrilli, VP - Technology Strategy

Chris Zangrilli is Vice President of Technology Strategy at Vertex Inc. In his role he leads the technology strategy and innovation efforts, applying emerging technologies to understand the art of the possible to drive growth. He has held several technology leadership roles responsible for the architecture and development of SaaS solutions. He brings 30 years of technology and strategic expertise driving value to customers through tax technology solutions.

7 Challenges Your Small Business Faces

Owning and running a small business is a dream of almost everyone. However, this is a big challenge, especially considering the problems you will likely face. While having the idea is the easiest part, starting and managing a business is not a simple task, as some might want to believe. The first two years of a business are the biggest problem, and most small businesses do not make it past this period. Those brave enough will successfully manage every aspect of the business starting from employees, marketing and administration, and ensure that they do not miss any leads. Here are some challenges that your small business might face.

- Getting customers

While starting a business can be simple, getting customers is a complex undertaking which can be painful sometimes. This is a challenge to startups and multinationals such as Toyota, Coca Cola and Apple, who have the right teams for marketing and customer support. As a startup, you do not have to sit there and wait for people to come and buy your product or service, hopefully. Rather, you must develop a comprehensive strategy to inform people about your product or service and buy it. This is a significant challenge for small businesses because they do not have a recognized brand that people already believe in.

- Cash flow problems

Small businesses often face the challenge of cash, and entrepreneurs are often afraid to start a business due to this reason. To sustain a startup, you need to spend a lot of cash and engage in various transactions, which can sometimes be challenging. As a startup, therefore, you need to track every transaction and be strict in managing your cash flows. Hire an accountant to help with bookkeeping and in managing your finances.

- Lead generation

Most businesses face the challenge of lead generation, especially in generating enough leads to satisfy the sales team. Marketers also report that this is a key challenge that business leaders face. Given this problem, it is hard to ensure there is a steady stream of sales and income.

- Overreliance on one customer

A single, large paying-on-time customer is excellent news for any small business. However, it can also be a major problem. Depending on a single customer for payments makes you appear like a contractor. If they suspend or stop their services, you might end up doing no business at all. While it is important to attract and maintain any customer, you need to find new ones to keep you going when others stop buying from you.

- Hiring talented employees

Getting the right people to work for your startup is one of the hardest things you may encounter as you start your business. This is a difficult challenge, especially since most quality employees are attracted to bigger brands. According to statistics, 52% of respondents in a CNBC study claimed that the biggest challenge they face is labour quality. This makes it hard for small businesses to get the right people who understand business goals and can work together.

- Managing workflow

Once you have the right people in place, the next big challenge is to manage the workflow. You must ensure that your team has the right tools and processes to do the right things and work efficiently. This is a problem for startups because some of these processes are new or not tried and tested.

- Financial planning

Finances are the backbone of any business. Unfortunately, many small businesses have a problem managing and planning their finances. With this problem, some overspend or fail to use their financial resources prudently, ending their businesses due to cash flow issues. Given this issue, small businesses must find the right planning methods for their finances to last longer in the markets.

Check These Options for Small Business Loans

Although many potential entrepreneurs have great business ideas, most of them face financial difficulties. This makes starting a small business daunting. Although a great business plan is critical for such a venture, financing is the top element that you need to realize success. Sadly, coming up with the right amount demands discipline and the ability to impress lenders. This may mean that you should have more than one financing option on the table because the traditional lenders have some range they consider before they can fund your idea. If you have a low credit score or lack collateral to give to the lender, there are other alternatives you can try out for your startup. Check these options for small business loans if they can help in your venture.

- SBA loans

The US Small Business Administration loans program is an amount of up to $50,000 given to small businesses looking to start or expand. The average amount is 13,000 administered by nonprofit community lenders. The SBA loans are easier to qualify for compared to larger loans. However, the key downside is that the funds might not be enough for all borrowers. The SBA’s flagship 7(a) loan program finances borrowers that want to start a business. However, the SBA 7(a) loans are hard to come by. They are given to established businesses with collateral, which can be an asset such as equipment or real estate that can be sold in case of a default. It can also take months to access the loans.

- Microloans

Microloans allow microlenders and nonprofit lenders to access startup business loans with little complexity, unlike the SBA program. The microloans are available outside the SBA program and help lenders, mainly those with shaky finances. The majority of microlenders focus on underserved small business owners whom traditional lenders often overlook. The terms for these loans are also better than others because they are given by mission-based organizations. This makes it possible for you to grow your business and establish better credit.

- Personal loans

As a business owner, you can also access personal loans such as those offered by online lenders. These loans are based on the personal credit history of the borrower. This makes personal loans a competitive option if your small business is too new to qualify for other non-personal loans. They can have high APRs of up to 36%, especially for bad credit borrowers. Therefore, this type of loan is the best option for borrowers with strong personal credit and income.

- Crowdfunding

This method has become one of the popular methods that small businesses use to raise money. Thanks to various platforms such as Kickstarter and Indiegogo that allow entrepreneurs to solicit cash through online campaigns, you can also do this. Instead of paying back the donors in the future, you give them gifts. Therefore, the online-crowdfunding campaigns are known as rewards-based crowdfunding. This approach is great for business owners who want to test their product or service with a specific customer base without debt.

- Grants

Small grants targeted at businesses by private foundations and government agencies are another great way of raising funds for your small business. The good thing about these grants is that they are not loans, and therefore they will not be hard to get. The challenge is that it might not be enough for a small business that struggles to start.

- Loans from family and friends

This is the most common way of financing startups. It entails borrowing money from friends or family who can lend. However, like a bank, if your credit is bad, you will have to convince them to pay back their money. When exploring this option, find the individuals who understand the risks involved and your plans.

Embracing Automation: Revolutionizing Business Operations

Explore how automation is transforming business operations, improving efficiency, and driving success. Discover real-life examples and strategies for successful integration.

Explore how automation is transforming business operations, improving efficiency, and driving success. Discover real-life examples and strategies for successful integration.

In recent years, enterprises have been turning to automation to streamline operations, enhance productivity, and reduce costs. This surge is largely driven by advancements in technology, making automation tools more accessible and effective.

Automation is not just a novelty but a necessity for businesses aiming to maintain competitiveness in today's market. For instance, robotic process automation (RPA) is being employed by numerous firms to manage repetitive tasks, such as data entry and customer service queries, with unprecedented efficiency and accuracy.

Companies like Deloitte have been at the forefront of embracing automation. They have successfully implemented automated systems in their auditing procedures, thereby improving accuracy and reducing human error significantly. Such initiatives have set a precedent, encouraging other businesses to adopt similar measures.

A real-life success story can be seen in a mid-sized retail company transitioning to automated inventory management, which led to a 30% reduction in operational costs and 40% faster fulfillment cycles. This transformation not only improved efficiency but also elevated customer satisfaction through quicker delivery times.

Despite the undeniable benefits, integrating automation poses challenges such as workforce displacement and the need for upskilling. Organizations need to approach these obstacles strategically by investing in employee training and redefining roles to align with automated processes.

Moreover, businesses should thoroughly analyze their operations to identify tasks best suited for automation. Implementing an automation strategy without compromising quality requires a delicate balance and a thorough understanding of technological capabilities.

In conclusion, the rise of automation is revolutionizing business operations. As companies continue to integrate these technologies, they not only enhance operational efficiency but also embrace a future where innovation drives success. Staying ahead in this dynamic environment demands adaptability, strategic planning, and a commitment to learning and growth.

Navigating Employee Retention Challenges: Strategies for Success

Discover effective strategies to navigate employee retention challenges, including fostering positive workplace culture, implementing talent management programs, and prioritizing open communication for success.

Discover effective strategies to navigate employee retention challenges, including fostering positive workplace culture, implementing talent management programs, and prioritizing open communication for success.

One of the most critical strategies in employee retention is fostering a positive workplace culture. Creating an environment where employees feel valued, respected, and motivated is essential for retaining talent. Companies like Google and Microsoft have set excellent examples by prioritizing employee well-being and offering flexible work arrangements, which significantly boost employee morale and engagement.

Additionally, implementing comprehensive talent management programs is crucial. These programs focus on identifying, developing, and nurturing internal talent, providing clear career paths, and offering opportunities for skill enhancement. By investing in employees' growth and development, businesses can demonstrate their commitment to their workforce, ultimately leading to higher retention rates.

Another effective approach is competitive compensation and benefits packages. While salary remains a significant factor in employee retention, other benefits such as health insurance, retirement plans, and work-life balance support are equally important. Companies like Deloitte have successfully retained employees by offering tailored benefits packages that consider the diverse needs of their workforce.

Furthermore, organizations must prioritize open communication and feedback mechanisms. Regular check-ins, performance reviews, and anonymous feedback channels enable employees to voice their concerns and feel heard by management. This approach not only helps in addressing issues proactively but also fosters a sense of belonging and loyalty among employees.

Incorporating these strategies requires a collaborative effort between HR departments and company leadership. By committing to a holistic employee retention approach, businesses can reduce turnover rates, enhance employee satisfaction, and build a resilient workforce ready to tackle future challenges.

Exploring the Surge in Remote Workforce Solutions

The surge in remote workforce solutions is transforming operations management for businesses, with enhanced employee productivity, flexible work policies, and improved work-life balance leading the change.

The surge in remote workforce solutions is transforming operations management for businesses, with enhanced employee productivity, flexible work policies, and improved work-life balance leading the change.

Many leading companies have recognized the potential of remote work in fostering employee productivity, reducing overhead costs, and expanding their talent pool. According to a recent report from Successful Business News, remote work has contributed to a significant increase in overall productivity levels.

A vital aspect of remote workforce solutions is the strategic implementation of communication tools. Companies are investing heavily in technology that ensures seamless connectivity and collaboration. Platforms such as Slack, Zoom, and Microsoft Teams have enabled teams to maintain constant communication, thereby enhancing coordination and project management.

Another noteworthy trend is the development of flexible work policies, permitting employees to choose their work hours. This flexibility not only boosts employee satisfaction but also aligns work schedules with natural productivity peaks. A well-known case is that of a pioneering tech firm, which noted a 20% increase in productivity after introducing flexible hour options for its employees.

Moreover, data from various studies suggest that remote work has had a positive impact on mental health, as employees can better balance their personal and professional lives. This balance has been a critical factor in sustaining employee morale and reducing burnout, ultimately leading to improved operational efficiency.

However, the transition to a remote workforce is not without challenges. Businesses are continually optimizing cybersecurity measures to safeguard their data and maintain client confidentiality. VPNs, multifactor authentication, and encrypted communication channels have become standard practices to counteract potential security threats.

Furthermore, assessing productivity in a remote setting requires innovative approaches. Employing performance analytics, management tools are crucial for gaining insights into employee performance and identifying areas for improvement. A case from my previous experience involved implementing such tools for a retail chain, resulting in significant optimization of their remote workforce operations.

In the long-term, remote workforce solutions are expected to become an integral component of business strategies. As the corporate world continues to navigate the complexities of this transformation, proactive measures in operations management will be the key to unlocking unprecedented efficiency and growth.

Navigating the Challenges of Remote Workforce Management

Explore the challenges and solutions in managing a remote workforce, focusing on communication, productivity metrics, and employee well-being, featuring insights from top firms like EY and Deloitte.

Explore the challenges and solutions in managing a remote workforce, focusing on communication, productivity metrics, and employee well-being, featuring insights from top firms like EY and Deloitte.

A key element in navigating remote workforce management is communication. Companies that prioritize clear communication channels find themselves better equipped to handle the intricacies of a dispersed team. Utilizing platforms like Slack or Microsoft Teams can streamline interactions and maintain team cohesion. Ernst & Young, known for their consultancy expertise, embraced digital communication tools early, fostering an environment conducive to remote operations.

Moreover, maintaining productivity in a remote setting requires a reevaluation of traditional performance metrics. Managers are shifting from input-focused assessments to outcomes-based evaluations. By setting clear expectations and focusing on deliverables rather than hours logged, managers can ensure their teams remain productive without the need for constant oversight.

Another critical aspect is the technology infrastructure. Investing in robust cybersecurity measures is vital as employees access company resources from various locations. Deloitte has been at the forefront of advising businesses on enhancing their cybersecurity frameworks, ensuring secure data handling and reducing the risk of breaches.

Employee well-being and engagement are also paramount. Remote work can blur the boundaries between work and home life, leading to burnout. Implementing regular check-ins, virtual team-building activities, and encouraging regular breaks can help alleviate these issues. PricewaterhouseCoopers (PWC) has implemented various employee wellness programs, ensuring their workforce remains engaged and balanced.

Successful remote workforce management requires a holistic approach that addresses communication, performance evaluation, technology, and well-being. By implementing strategic solutions, businesses can overcome the challenges posed by remote work environments and thrive in this new operational paradigm.

Grants Still Available

According to Small Business Trends, the federal American Rescue Grant continues to provide grants to small businesses.

The economic stimulus grants provide small businesses can be the difference between staying open and closing entirely. Even before the pandemic, small business grants offered great opportunities to keep operating as well as support growth with strategic funding.

Read the article Small Business Trends

Small Business Owners' Health Needs Constant Attention

Running your own business can be hectic for many business owners. For small business owners, however, having all the responsibility to all operations, including successes and failures, can be detrimental to one’s health. Sadly, health among small business owners has not been taken seriously as it should despite the economic significance of such businesses to society and the economy. The mental health of small business leaders leads to a healthy working environment. It also leads to effective teams that are characterized by respect and trust in one another.

Large corporations with complex and well-structured succession plans can hardly be affected by health issues that may affect their leaders. The well-laid down succession plan ensures that in the absence of the CEO, operations run without hitches. Unlike big multinationals whose operations cannot be affected by the health issues among those in the high offices, poor health among the leaders of small businesses can end operations and render employees jobless. The simple structure of a small business is risky, and the impact of the demise of a CEO is unimaginable. With an instant disease or a condition such as a heart attack, everything can go down the drain since everything revolves around an individual. From this, it is evident that health is the greatest capital of small business owners. The smaller the firm, the higher the vulnerability in case the owner develops health complications, either physical or mental.

The health of such business owners may have damaging consequences not only for those that have been employed but can also impact those that depend on them entirely. For example, the family members who rely on the owners can also be significantly impacted. Similarly, health problems among the personnel and family members can destabilize operations and how the business runs. Small business owners face many challenges that often affect their mental wellbeing. According to a Danish study, there is a significant link between entering entrepreneurship and receiving prescriptions for sedative or hypnotics and/or their spouses. This is a clear suggestion that entering entrepreneurship is a health risk as it is a potential source of stress for entrepreneurs and their family members.

Many studies have found out that stress level among the business owners is higher than those of the employed. The always conflicting issues such as ambiguity in the business environment, lack of adequate resources, and daily hassles as well as failure to clarify roles increase stress and the possibility of health complications. Work overload is another factor that many small business owners face and may result in a complication. Entrepreneurs often work for more than 50 hours a week. Working for long hours, including weekends doing intensive tasks, is a potential cause of stress.

Uncertainty is often identified as another factor that can cause health problems among self-employed individuals. The fast-changing business environment is always a concern for entrepreneurs who are always worried about their businesses in case things do not go as planned. These owners have many things to worry about, including their employees, government regulations, and reduction in profits, all of which determines the success of their businesses. Loneliness of business owners also results in burnouts, which in itself is a potential contributor to mental health. Loneliness can be harmful in an environment where difficult decisions are to be taken, such as firing or hiring employees.

As seen above, health issues among the small business owners have severe spillover effects on those they employ and their families. Unlike CEOs of large companies that have a proper succession plan, health challenges among small business owners can cripple operations. As such, it is crucial to always stay ahead by addressing potential causes of health problems before they manifest into catastrophes.

Is Now the Perfect Opportunity to Retire?

Even before the coronavirus pandemic struck and sank the world’s economy, retiring at the age of 65 was already becoming a hot topic among many professionals. Now that the pandemic has impaired many businesses, both small and large plans of many organizations are in shambles. One of the areas that have been significantly affected is retirement. Business owners that were planning to retire are now forced to rethink. This could mean that the retirement age is likely to fall further as employees try to pick up from where they left once the economy reopens and the pandemic eases.

Although the recovery is expected to happen sooner or later, it may take some time. This is if the 2007-2009 recession is an example to go by. The recovery time can even be longer considering the severity of COVID-19 compared to the recession witnessed in 2009. As such, many small business owners may be tempted to consider selling their businesses rather than waiting for things to get better.

A study by StreetWise Retirement Confidence Index in May indicated that 26% of those interviewed stated that they would postpone their retirement plans after the coronavirus. Their decision is due to the economic conditions that the virus has caused. As damaging as they may seem, the decision is not surprising, given the uncertainty and fear that the pandemic has caused in many industries in different countries. The uncertainties have had an impact on the financial strategies of organizations and have forced many businesses to change their priorities. Another study by Allianz Life Insurance Company found out that almost half of Americans interviewed went into early retirement for reasons beyond their control. One of the reasons that were cited in the research is job loss. This was cited by 34% of the respondents, while 25% cited health challenges as their primary reason for retiring early. As an entrepreneur or employee who is willing to persevere and try their best to achieve their dreams, all is not lost. Taking some steps can enhance value and build your business so that you can sell more and retire as you planned or even early.

Creativity is one of the ways that can help you remain open in the current era of uncertainty. As a business owner, try your best to find creative ways that can adapt to the changes in the business environment. One way you can do this is by adding other services that will replace the revenue that has been lost. For example, as a restaurant owner, you can supplement the revenue lot by ordering food and selling them. This will create a new stream of income and increase profits even when other sources of revenue are not doing well enough.

A good rapport with banks is also crucial to businesses. Regardless of the size of your organization, always ensure that you have a good relationship with financial institutions. Having a wrong sense of security will only deceive you, and you will not have anyone to turn to in case things become tough. With the right relationship, you will have someone to run to for loans when the revenue stream dries up, and you need additional funds to keep running. Always ask yourself, is my bank relationship stable? If the answer is yes, then you are in the right place.

Coming up with a transition plan is another approach that you must consider. Just because you are delaying your retirement plans does not mean that you should not establish a transition plan. Take time to build a working transition plan that will not leave your organization in chaos when the right time comes. Most business owners lack a proper transition plan. This leads to a lack of focus on what is needed for a business to operate successfully.

Thinking Ahead About Getaways

It’s a good strategy to be forward-thinking and plan for the future, so now is a fine time to consider future vacation ideas. Not only will you have something exciting to look forward to, but you may need a longer lead time to put one of these plans in motion.

There are few places on Earth that are more remote, exotic, and accessible as Hawaii. With direct flights from almost all major US cities, and no passport required, Hawaii is a great destination to feel like you have left the monotony of day-to-day life behind. What’s even more exciting about getting to the most far-flung US State is that there are multiple islands, with 4 very different vacation styles for every taste. The big island offers no shortage of adventures, from walking across a volcano to snorkeling with sea turtles and manta rays, to tropical hikes with breathtaking waterfalls. Oahu provides the familiar hustle and bustle of city life with picturesque beaches. Maui is the most popular destination, with relaxing beaches and lively nightlife both. Finally, Kawaii is the most relaxing and serene of the islands.

If you prefer to stay in the continental US, the Southwest has plenty of adventure! From riding dune buggies through the desert to a train ride to the Grand Canyon, there is a right-pace adventure for everyone. Relax in a hot air balloon over Albuquerque or relive the old west with a trip through Tombstone, Arizona and other gold-rush towns. Few images are as inspiring as a desert sunset over the mountains, and once the sun goes down, the action never stops in Las Vegas.

Stretching along the Coast, there’s many options for a memorable vacation. Traveling to New England may seem like quite a change of pace, but there is plenty to keep one busy from Maine down to Connecticut along the coast. Enjoy a lobster dinner on the oceanside, hike through some of the nations oldest states and national forests, and get lost in miles of winding roads. Boston or Portland make perfect bases of operation to go a few hours north to the backwoods of Maine or to enjoy the finest foods from a wide variety of different cultures right in Boston or Providence.

While you won’t be able to enjoy an ocean view, the Midwest offers plenty of excitement as well. The mighty Mississippi touches 10 different states, each one with different scenery to enjoy. Whether you’re up for rugged hiking in Minnesota or a leisurely cruise on the river in Louisiana, the Mississippi River has dozens of perfect destinations along it’s 2320 miles. St. Louis boasts some of the region’s best museums while Memphis, Tennessee is a must-see for Elvis fans everywhere.

No matter where your interests take you, across our vast nation, there are ideal vacation destinations to be had. From coast to coast, you can’t go wrong planning your vacation in any region. Take your mind off any current worries, let your dreams loose, and plan ahead.

Popular Articles

- Most read