Accounting/Banking/Credit (109)

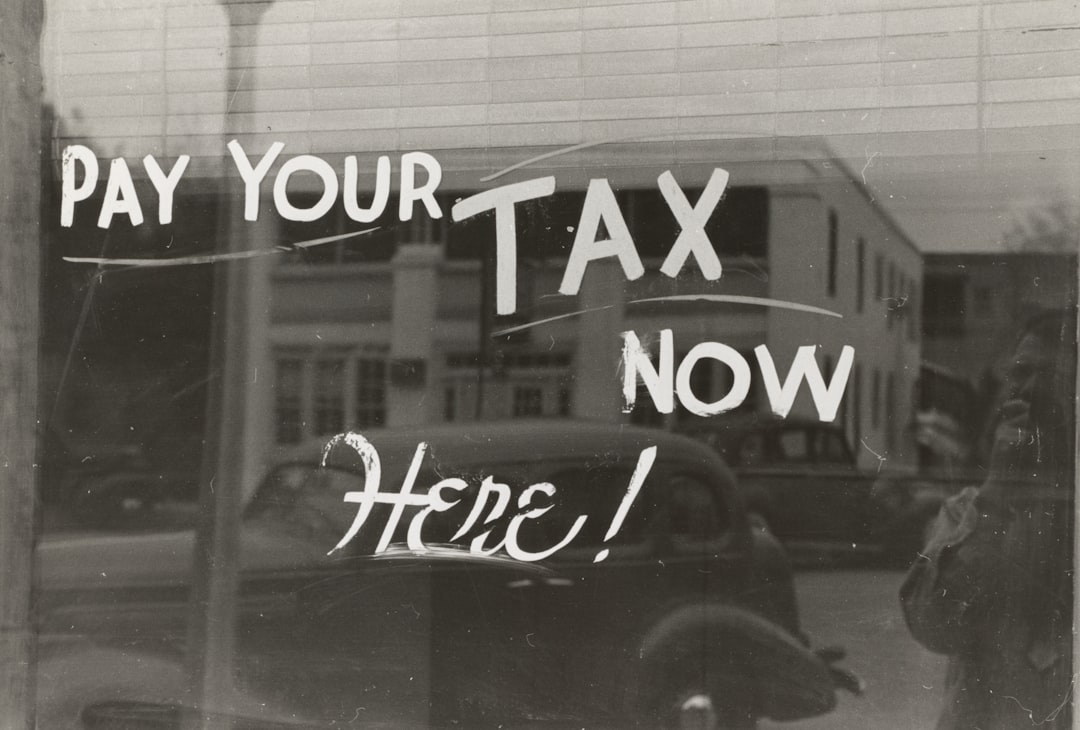

Do You Know About These 2020 Tax Changes?

- Monday, 24 February 2020

- Accounting/Banking/Credit

- Written by Deborah Huyett

Before too much time passes this year, it’s best to get a jump-start on Tax Season. Taxes are just around the corner, so learn about the new changes to 2020 taxes now to avoid any surprises. There just might be a few benefits in the new code that will positively affect you and your business, but also beware any changes that could cause problems if you are noncompliant.

Read more...What Is A Good Loan For A Small Business?

- Monday, 10 February 2020

- Accounting/Banking/Credit

- Written by Deborah Huyett

Unless you’ve received some sort of windfall or have another source of cash, you’re going to need money to fund a new business. The easiest and most readily available source of cash is a business loan, a reasonable step to take for a start-up.

Read more...There's More Than One Way to Crowdfund Your Business

- Monday, 03 February 2020

- Accounting/Banking/Credit

- Written by Scott Koegler

Crowdfunding is helping many startups and small businesses get cash for their respective projects from a variety of sources. However, despite the availability of various crowdfunding sources, many people still have little knowledge on most of them which make it difficult for them to get the money they need to propel their businesses to the next level. In this article, we highlight various methods that you can use for your crowdfunding campaigns and other options of funding that can be helpful to your business.

Read more...Small Businesses Look to Fintech to Change How They Seek Financing

- Monday, 02 December 2019

- Accounting/Banking/Credit

- Written by Scott Koegler

The rise of artificial intelligence, big data and machine learning is changing the way small businesses are doing things. Banking institutions are in a hurry to collaborate with fintech providers to find solutions that offer small businesses an opportunity to seek financing. In countries like the United States, for example, there are more than 30 million small businesses that make up about 99% of all businesses in the country. They offer employment to millions of citizens and contribute immensely to the economy. As the gig economy continues thriving, financial institutions are seeing a booming market that can generate massive returns from small businesses.

Read more...The Importance Of Establishing Payment Terms

- Monday, 25 November 2019

- Accounting/Banking/Credit

- Written by Deborah Huyett

Do you see yourself in the following? Your customer base is starting to increase, you’ve shipped your product on time, invoiced you customers, and now it’s time to get paid. But, wait—Did you establish payment terms? Many new businesses leave payment up to inertia, believing that payment will follow work provided, but not all customers will observe that formula. For the most part, clients and customers want to do the right thing and pay, but things happen. Sometimes, you find that exception who doesn’t pay timely or avoids payments.

Read more...Managing Your Cash Flow

- Sunday, 03 November 2019

- Accounting/Banking/Credit

- Written by Scott Koegler

Have you ever tried to paddle a boat with no oar? Well, trying to operate a business without proper cash flow management is like doing this. Even if you succeed, you will have faced an uphill task that is not worth it at all. Delays in paying your suppliers and employees and failing to collect cash from your customers on time can be a big issue to your business and the only way around it is to have a proper cash flow management.

Read more...Tune up Your SMB Bookkeeping to Avoid Costly Mistakes

- Tuesday, 01 October 2019

- Accounting/Banking/Credit

- Written by Eddie Davis

The combination of vision, gumption and hard work can bring small businesses to life. Keeping them going, however, can be more of a challenge, especially if management doesn't have a solid handle on financial reporting. That begins with accurate, timely and dedicated tracking of financial transactions and proper handling of various tasks that are essential for a business to thrive, such as invoicing customers, managing payroll and paying the firm's bills on time.

Read more...How To Prepare For The End Of Your Fiscal Year

- Monday, 26 August 2019

- Accounting/Banking/Credit

- Written by Deborah Huyett

Whether your fiscal year matches the calendar year or ends in the middle of September, at some point, you must close the books on this year and open them on next year. What’s the best way to prepare for the transition from last fiscal to the next fiscal year? That depends on the goals for your business.

Read more...Business Lending: What is a personal guarantee?

- Monday, 05 August 2019

- Accounting/Banking/Credit

- Written by Scott Koegler

In business lending, a personal guarantee is a very crucial element. It is a legal promise by the owner or owners of a business that in case a business fails to repay a loan, they will personally repay the outstanding debt. Although a loan can help to fund your business, in most cases, personal finances can end up being dragged into the picture in the form of personal guarantee. The banking institutions or other parties that lend money often demand a personal guarantee from the borrower to ascertain that the loan will be repaid even if the company does not have assets that assure repayment on its own.

Read more...What Should you Include in Your Corporate Credit Card Agreement?

- Monday, 01 July 2019

- Accounting/Banking/Credit

- Written by Danielle Loughnane

Well-established companies generally provide their Sales and Executive team with corporate credit cards to use for travel expenses and networking activities such as dinners and Happy Hours. Company-issued credit cards allow employees to expense work-related expenditures without having to rely on their personal credit card alleviating the stress of incurring late fees. If you are looking into the benefits of a corporate credit card, there are a few things you should know before making a decision.

Read more...Most Read

-

-

Feb 08 2012

-

Written by SBN Editors

-

-

-

Sep 08 2011

-

Written by Editor

-

-

-

Jun 18 2013

-

Written by News

-

-

-

Nov 14 2012

-

Written by SBN Editors

-